E-Invoicing (PREVIEW)

THIS PAGE IS NOT FINAL

Overview

On this page you will find information about our E-Invoicing access to our customers in connection our general invoicing & contracts.

If you have any questions, you can always contact our support team at [email protected].

eBilling / E-Rechnung / Digital Invoice / XRechnung (EN 16931)

As a digital invoice, we generally offer all invoices (new as well as existing/historical) as PDF invoices.Digital invoice implementation at 25Space

As digital invoices, we issue fully available invoices in accordance with the relevant DIN templates. The only difference is that we add up all items as a total invoice for the previous month; you can still find exact details in the PDF. You can recognize the total invoice by the item number “2508241”. You will receive the digital invoice via the familiar communication channels, usually together with the standard PDF invoice. You can also call up the digital invoice for all new and most existing invoices. Further preparations are currently being made for e-billing and X-billing.

Access Options

Digital invoice - Access for old/existing invoices (AVAILABLE)

Existing and future invoices can be downloaded as PDFs and e-invoices via the login in the Cloud Management Suite in the settings under “Invoices”. Existing invoices can also be retrieved as e-invoices retrospectively until January 1, 2021.

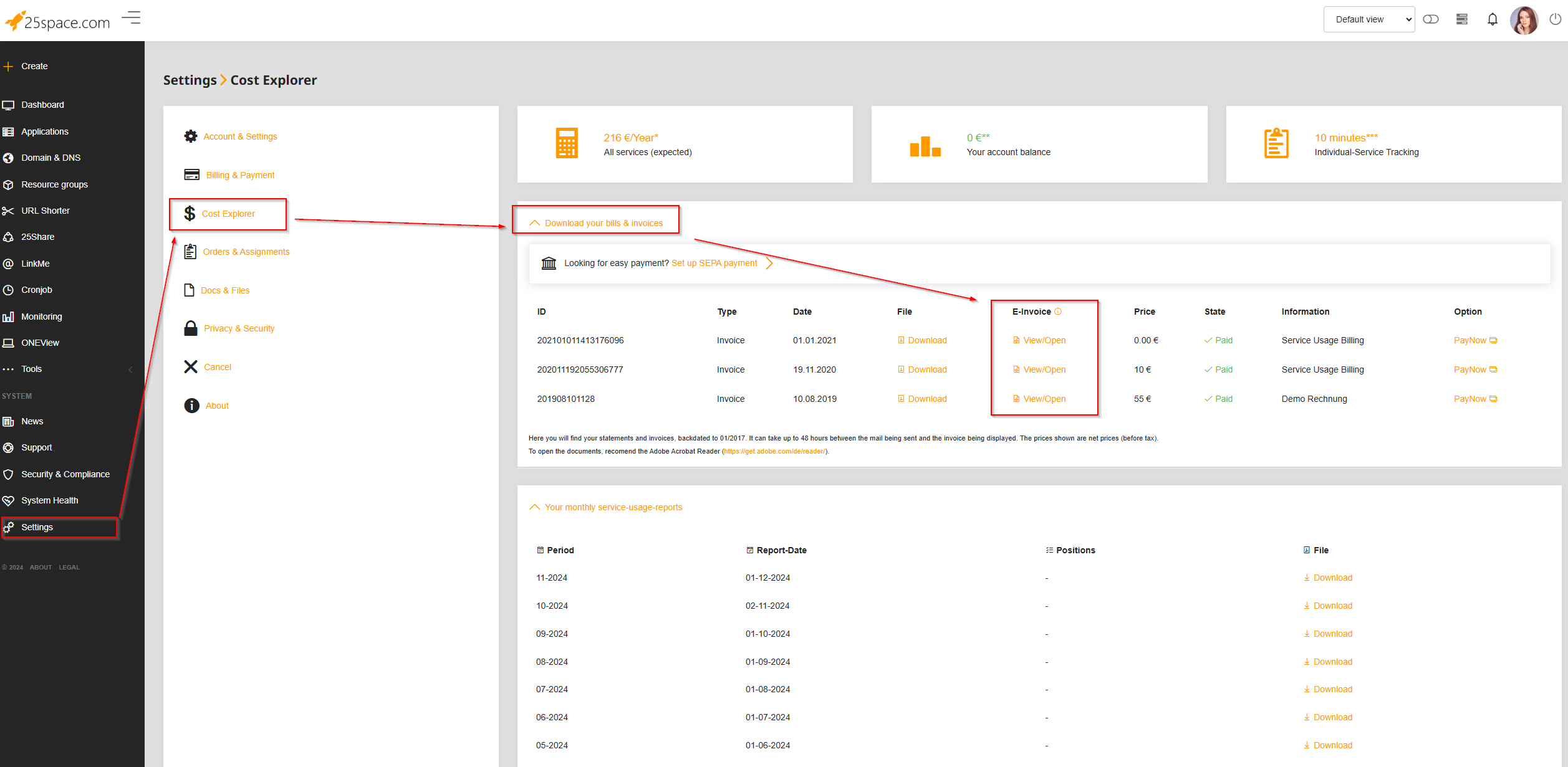

To do this, log in to the Cloud Management Suite with your access data, select Settings > Cost Explorer > Download your bills & invoices. There you will find all your invoices as PDFs, and retroactively until January 2021 also as XRechnung (XML).

Login to your Cost Explorer here >>

Digital invoice - Access new invoices from PDF (AVAILABLE)

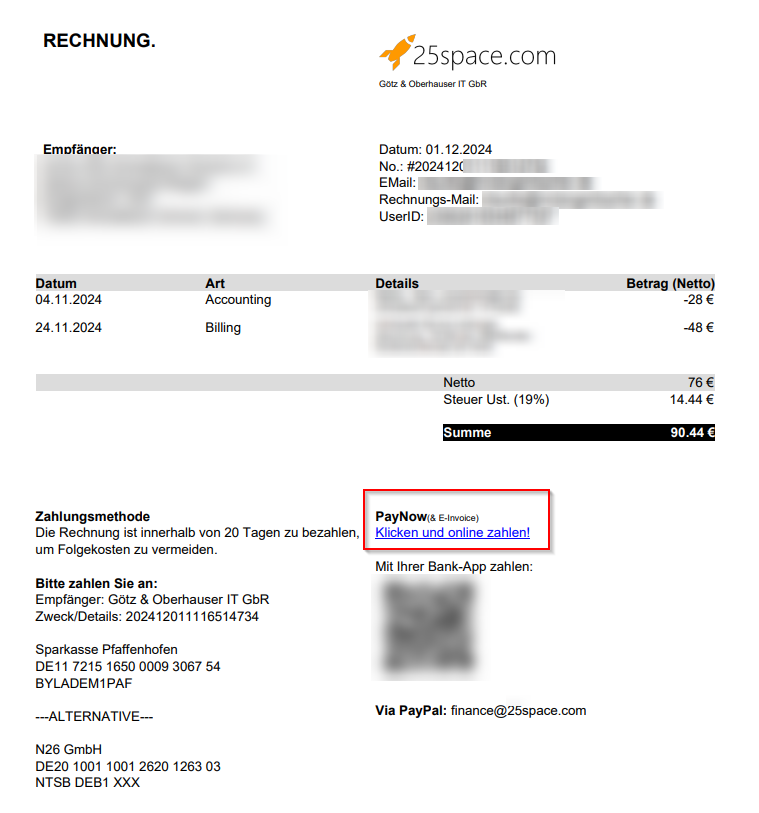

In PDF invoices (starting from December 2024), select the specified link to “PayNow” if it has the addition “& E-Invoice”. Further information on PayNow can be found further down in this article.

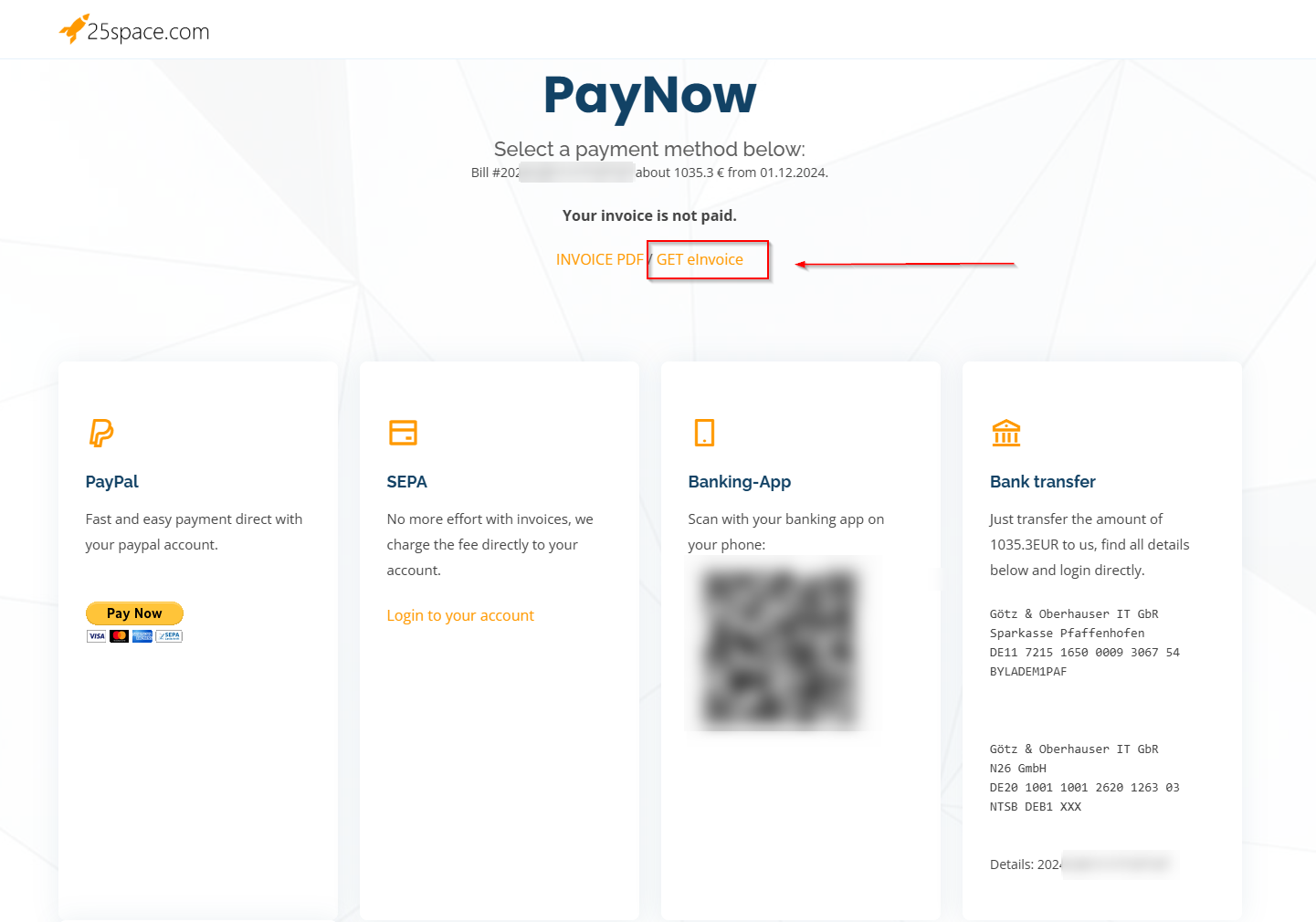

Digital invoice - Access new invoices via PayNow (AVAILABLE)

PayNow is a separate service that gives you access and information for paying your own bill. From there, you can easily and conveniently switch to the usual payment methods. You can also call up your PDF and e-bill directly from there.

You will find the link to PayNow on your PDF invoice as well as in your invoice email. If you have your invoice number to hand, you can access PayNow via the following link: Open PayNow & enter your InvoiceID >>

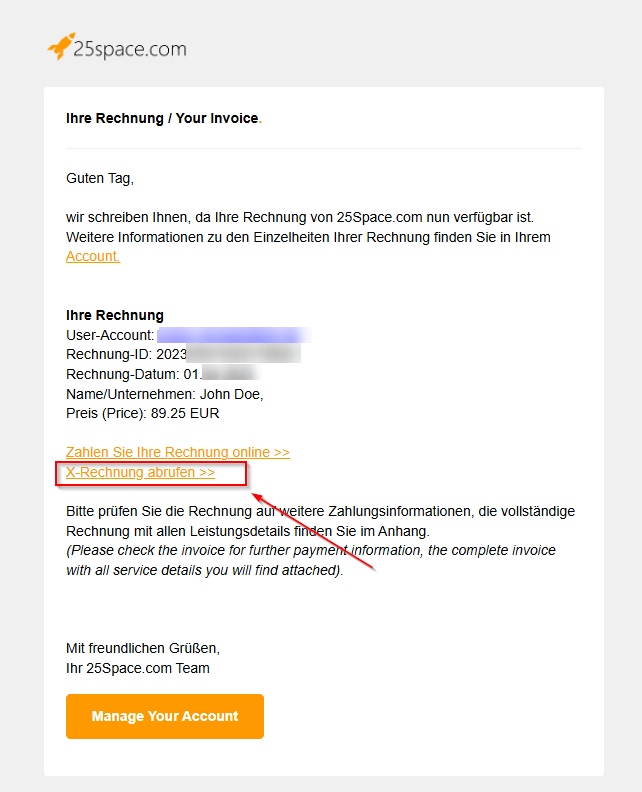

Digital invoice - Access new invoices via email (AVAILABLE, starting 01. January 2025)

In the invoice e-mails (from January 2025) you will find a direct link to your e-invoice. These will be linked (or similar, depending on the payment method) in the invoice email as follows. Your e-invoice will open directly:

Invoice codes & Options

Invoice Type

| Code | Description |

|---|---|

| 380 | Standardrechnung – Commercial Invoice |

| 381 | Gutschrift – Credit Note |

| 384 | Teilrechnung – Partial Invoice |

| 386 | Proforma-Rechnung – Proforma Invoice |

| 875 | Stornorechnung – Cancellation Invoice |

| 383 | Selbstabrechnung – Self-billed Invoice |

| 389 | Lastschriftsanzeige – Debit Note |

| 35 | Vorabrechnung – Prepayment Invoice |

Payment Type

| Code | Description |

|---|---|

| 30 | Überweisung – Credit Transfer |

| 42 | Lastschrift – Direct Debit |

| 58 | Scheck – Cheque |

| 10 | Barzahlung – Cash |

| 20 | Kreditkarte – Credit Card |

| 48 | Mobile Zahlung – Mobile Payment |

| 1 | Andere Zahlungsmethoden – Other |

| 49 | E-Wallet – Electronic Money |

| 50 | Banküberweisung auf ein Treuhandkonto – Bank Account |

| 97 | Sonstige Überweisungen – Local Transfer |

Tax-Rate Type

| Code | Description |

|---|---|

| S | Standard rate – Der Standardsteuersatz (z. B. 19 % in Deutschland). |

| Z | Zero rate – Umsatzsteuersatz 0 %, z. B. bei exportierten Waren oder steuerfreien Leistungen. |

| E | Exempt – Umsatzsteuerbefreiung, z. B. bei medizinischen oder Bildungsleistungen. |

| AE | Reverse charge – Übergang der Steuerschuldnerschaft, bei grenzüberschreitenden Leistungen. |

| O | Out of scope – Transaktionen, die nicht in den Anwendungsbereich der Umsatzsteuer fallen. |

| G | Free export – Export von Waren oder Dienstleistungen außerhalb der EU. |

| H | Higher rate – Ein erhöhter Steuersatz (falls im Land verfügbar, z. B. 25 % in manchen Ländern). |

| AA | Lower rate – Ein ermäßigter Steuersatz (z. B. 7 % in Deutschland für bestimmte Güter). |